Can A 70 Year Old Get Long Term Care Insurance

Family members will receive the amount stated under the coverage. Should I buy Long Term Care Insurance.

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Some companies will offer Short Term Care or Home Health Care policies up to age 85.

Can a 70 year old get long term care insurance. I keep busy and love to travel. At the age of 70. When you obtain the term life insurance policy at 70 years old you will inevitably pay a premium that will.

Some of the carriers that provide a living benefit for paying for long-term care costs by accelerating the death benefit of a life insurance policy are. I want to live comfortably in a nursing home when ever that happens but dont. When you obtain the term life insurance policy at 70 years old you will inevitably pay a premium that will increase dramatically over the next 10 years.

The monthly premium at age 50 is significantly less than at ages 60 or 70. Avoid Term Life Insurance While term life insurance is the most common life insurance on the market today it is not the best option for seniors over the age of 70. Costs increase on your birthday.

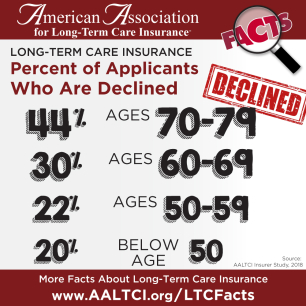

In 2009 new buyers of individual long-term care insurance were the following ages. The nations long term care insurance expert notes that after age 80 purchasing long term care insurance can be a daunting almost impossible task. The time to purchase Long Term Care is when you are healthy and in your fifties or sixties.

The insurance company will check your medical history and require that you take medical exams. It means that should a policy owner die during the next 10 20 years the beneficiaries eg. For 2020 the ltc or long term care insurance deduction limits changed.

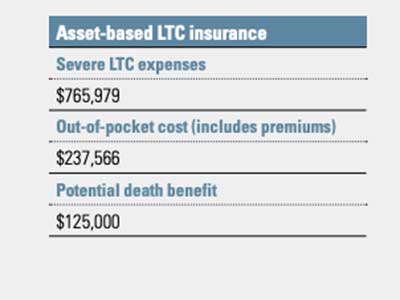

If you can sustain 6 months to a year of nursing homeassisted living costs this might be a great option for you. Under age 54 265. However when factored against total premiums paid to age 79.

It makes sense for them to purchase term coverage as long as they are only going to need the coverage for another 10 to 15 years. Only after you passed these qualifications will you be issued a policy. Is it worth the money at my age.

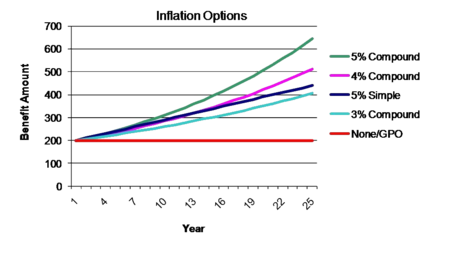

A new video posted by a trade group explains an option worth considering. Daily and monthly benefits aside critical care and critical illness insurance are normally less expensive than long-term care insurance. Premiums for long-term care insurance are based on your age when you apply.

For years long-term care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day-to-day activities such as bathing dressing and eating meals. I checked into the insurance and it will cost me about 9000 a year. For example say youre 66 years old right now and as of today you qualify for the long term care insurance to kick in but youve selected a 1-year elimination waiting period.

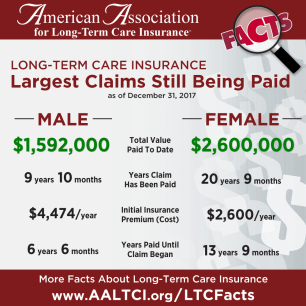

However term policies only offer coverage for 10-15 years in your 70s which may not be best for many people. For example the typical premium for a married 50-year-old in good health is approximately 27 less than the same coverage for a buyer at age 60 and 62 less than the same coverage for a buyer at age 70. It is possible to still purchase long-term care insurance at age 75 according to the latest information shared by the American Association for Long-Term Care Insurance.

That will cover 164000 in benefits when the policyholder takes out the insurance and. The annual rate increases are generally 2-4 percent in your 50s but start to be 6 to 8 percent per-year in your 60s. Recent age limits have been placed on term policies however.

First someone 70 will generally have an objective of having coverage last for a lifetime instead of a period of time. Long-term care insurance is a specialty type of insurance that helps pay for costs that are typically associated with long-term care LTC. The short answer is yes however at this age you may find it a much better alternative to purchase a permanent policy.

Go here for final expense whole life quotes age 72 and for ages 70 to 79. I am healthy but dont know what the future will bring. These costs can include things like care.

I am a 73 year old active female. Life insurance rates for a female 70 years old smoker Two overviews below show the minimal life insurance premiums for a policy holder of Term 10 and Term 20 insurance products. It is no different than.

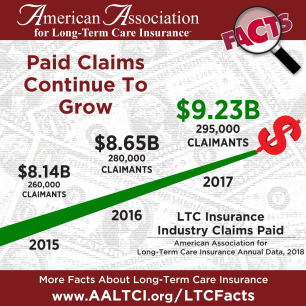

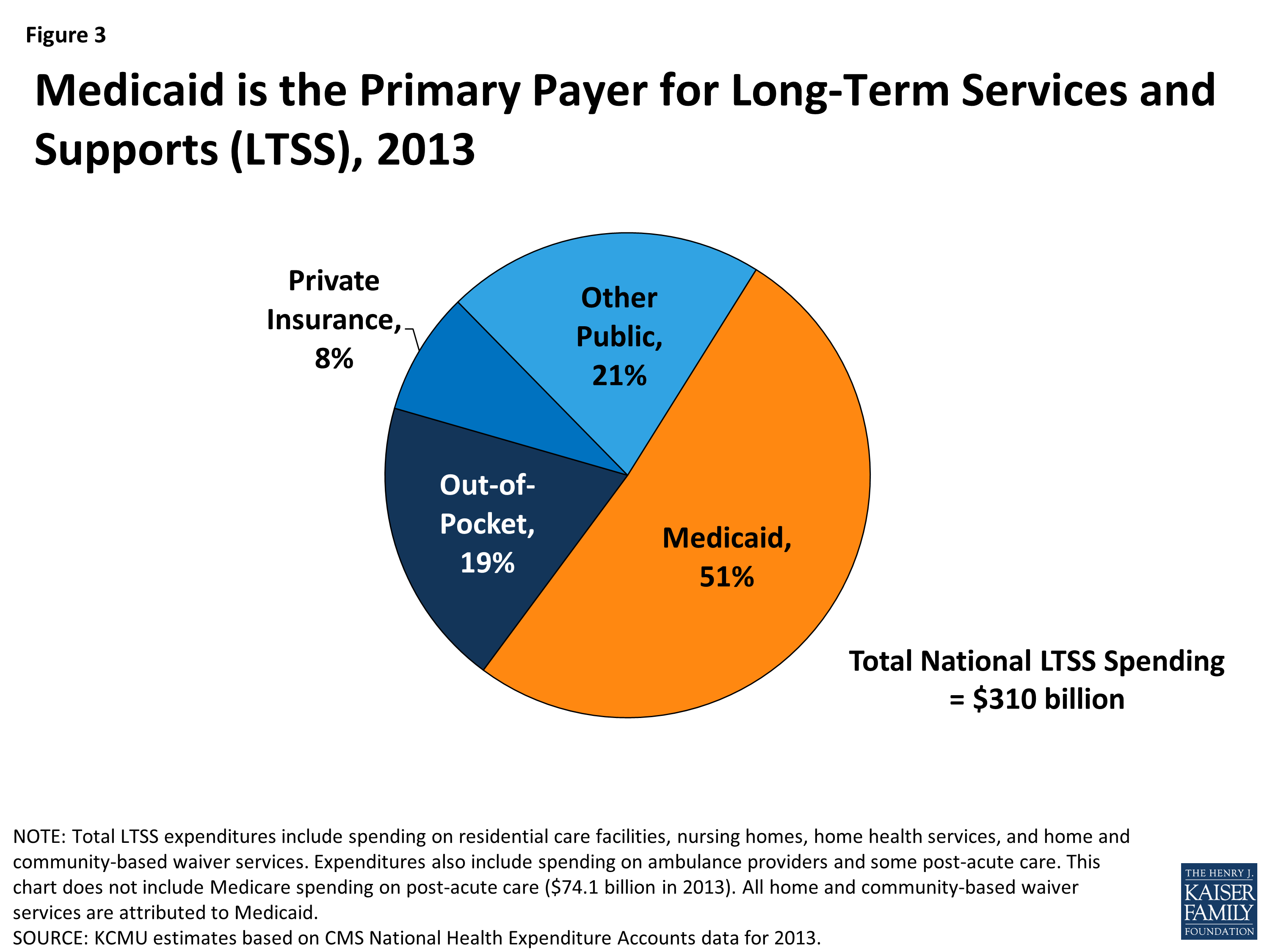

The major insurers have ceased offering coverage to those over age 80 because few people would agree to pay the premiums and even fewer could meet the health qualifications Slome explains. Medicare only pays for long-term care needs under very specific circumstances and for a fairly short period of time a maximum of 100 days. Long Term Care Insurance Option For Seniors Between 75 and 79 Explained Los Angeles CA Aug 5 2015 Finding long term care insurance coverage after age 70 is difficult as leading insurers scrutinize health and most stop issuing new policies after age 75.

Typical terms today include a daily benefit of 160 for nursing home coverage a waiting period of about three months before insurance kicks in and a maximum of three years worth of. For example if a 60-year-old woman is looking for. Long term care insurance is issued based on the insurance companys medical underwriting.

There are some alternatives however. I do not know of any company that will issue a Long Term Care Policy to an eighty year old and if there were the premium would be extremely high. As the population ages people may believe that health insurance or the government will pay for their long-term care needs.

I have about 500000 in investments. For example some carriers have limited the age of adding an LTC rider to a life insurance policy.

Best Long Term Care Insurance In 2021 Retirement Living

They Chose Not To Get Insurance They Chose To By 200 Dollar Shoes Over Health Insurance Why Do I Have To Pay For Th Cheap Car Insurance Quotes Insurance Quotes Best Insurance

Long Term Care Insurance 70 Chance Long Term Care Insurance Benefits Of Life Insurance Long Term Care

Best Long Term Care Insurance In 2021 Retirement Living

Best Long Term Care Insurance In 2021 Retirement Living

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

How Much Does Long Term Care Insurance Cost Smartasset

There Are Times When Short Term Care Insurance Makes More Sense Than Long Term Care Insurance Discover The Ltci Long Term Care Insurance Solutions Infographic

Do You Really Need A Long Term Care Plan

Long Term Care Insurance In Germany Pflegeversicherung

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Long Term Care Insurance Inflation Protection Options Long Term Care Insurance

Long Term Care Needs Long Term Care Insurance Long Term Care Life Insurance Quotes

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Genworth S Spia Helps People Too Old Or Sick To Qualify For Long Term Care Insurance Or Other Annuities Long Term Care Insurance Annuity Helping People

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Long Term Care It S Coming Are You Ready Ltc Long Term Care Insurance Long Term Care Life Insurance Policy

Post a Comment for "Can A 70 Year Old Get Long Term Care Insurance"