Cosign Auto Loan Credit Score

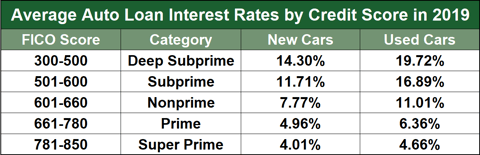

Generally lenders will require a potential cosigner to have a credit rating score of 700 or above. This is obviously just an example but you can see that a cosigner can save you a lot.

What Credit Score Do You Need To Get A Car Loan

If you have solid credit for example a FICO score above 800 and youve been problem-free for years the effect might be minimal.

Cosign auto loan credit score. The cost of securing loans with a bad credit score is high. But if you have fair credit or if youve never established credit accounts at all be careful. Essentially a cosigner agrees to pay the borrowers loan if the borrower defaults on it.

They usually have a lengthy credit history and a good credit score. If your friend or family member doesnt make a payment on time or at all that can also show up on your credit reports and could negatively affect your credit scores. A credit score in that range generally qualifies someone to be a cosigner but each lender will have its own requirement.

What credit score does my cosigner need for a car. The first is with your credit score and record. Although there might not be a required credit score a cosigner typically will need credit in the very good or exceptional range670 or better.

The average score for a new-car buyer is 732 and 665 for used-car buyers according to Experian. Cosigners Credit Score and Income Requirements. This means at the very least a credit score of 670 or higher is most likely required by most lenders in.

If you have bad credit your. Score Update Its a good idea to check your credit scores and have your cosigner review hers before applying for a loan. Your cosigners credit score should be higher than yours.

If I have cosigned an auto loan recently am I able to cosign another auto loan right. To be a cosigner your friend or family member must meet certain requirements. If your score falls below 620 youll find it difficult if not impossible to get an auto loan unless you make a big down payment.

People with this range of credit score and higher are generally very financially responsible and pay their bills and obligations on time. The point is that its your car and youre responsible for making timely payments so it wants to make sure you earn enough money to pay for it and abide by the loan agreement. A good number of borrowers would have a hard time getting first-time credit without cosigners.

A cosigner increases the odds of someone with bad credit getting a loan. Cosigners usually need to have a score of at least 700 or better in order to qualify. On a 20000 loan people with low credit scores pay an average of 5000 more than those with strong credit scores.

Co-signing for a car loan means you are agreeing under a legal contract to be equally responsible for making sure the bill gets paid on time and the account will appear on both your credit report and the credit report of anyone else listed on the loan. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of 300 for an APR of 1151. Since youre the primary borrower the lender will take a close look at your credit score employment history and length of time at your current address.

When you co-sign a loan the loan can show up on your credit reports. While there is no set credit score needed to buy a car the highest scores tend to yield the lowest rates. Whose Credit is Affected.

A co-signer with excellent credit can help. How Co-Signing a Car Loan Will Affect Your Credit There are two primary ways that co-signing a loan can affect your credit. This could also affect your ability to get approved for a loan of your own down the road.

Youll never be asked for your credit card information and along with your scores youll receive expert advice on improving your credit. If your score is too low or the lender feels for other reasons that youre unlikely to be able to make your payments its possible that even with a co-signer you will be turned down. Since you are obligated for the debt a co-signed loan will show up on your credit report as if.

Typically this means having a qualifying minimum income like you but with a much higher credit score. Cosigners must meet certain requirements in order to successfully help you get auto financing. If you manage your cosigned loan payments responsibly you can reap the benefits and watch your credit score climb over time.

This is even if you have a cosigner. That said co-signing for a loan can potentially help you build up your credit. Thats 12637 in interest and around 701 in monthly payments.

Auto Credit Express requires bad credit applicants to earn at least 1500 per month to qualify for a loan. Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. If you financed at 10 without a cosigner for the same terms youd pay a total of 50488 for the vehicle.

Although there is no hard and fast number your cosigners credit score has to be it does need to be in the good range. Benefits of Co-Signing For borrowers with horrible credit scores or no credit history at all a co-signer can be a lifeline that allows them to get a car.

Does My Cosigner S Credit Score Matter For An Auto Loan Auto Credit Express

How To Find A Cosigner For A Car Loan Yourmechanic Advice

Can A Cosigner Remove The Primary Borrower On An Auto Loan

Cosigner Basics For Auto Loans The Car Connection

How To Get A Car Loan Without A Co Signer Recommended

Cosigner Basics For Auto Loans The Car Connection

3 Auto Loans With Cosigners Optional 2021 Badcredit Org

How To Get A No Cosigner Car Loan Without Credit History

The Ultimate Cheat Sheet For Cosigning A Loan Credit Com

Avoid Terrible Credit Score Auto Loans With No Down Payment Bad C

Cosigner Consequences What Happens If I Don T Pay Creditrepair Com

How To Find A Cosigner For A Car Loan Yourmechanic Advice

Can A Cosigner Or Co Borrower Help Your Bad Credit Car Loan

How Does A Cosigner On A Car Loan Work Auto Credit Express

How Does Cosigning A Car Loan Work And Can It Improve Your Credit

3 Things You Should Consider Before Co Signing For An Auto Loan Consumer Financial Protection Bureau

Is It Easier To Get A Car Loan With A Cosigner Auto Credit Express

How Much Does A Cosigner Help On Auto Loans Auto Credit Express

Post a Comment for "Cosign Auto Loan Credit Score"