Can A 75 Year Old Get Long Term Care Insurance

You can pay for the policy but your parent will be listed as the insured beneficiary. Call MAGA the long term care specialists at 8800-388-2227 to get a quote.

Do You Really Need A Long Term Care Plan Long Term Care Insurance Life Insurance Marketing Ideas Life Insurance Marketing

Age 79 is generally the cut off explains Jesse Slome director of the long-term care insurance industry group but being accepted for this important coverage is going to be.

Can a 75 year old get long term care insurance. Absolutely yes you can get coverage for long-term care if you have pre-existing conditions. Also as we age we often begin to have health issues that can make you uninsurable regardless of age. The insurance company will check your medical history and require that you take medical exams.

Long-term care insurance and my big toe. The lowest maximum age that I know of is 65 with Lincoln Nationals single premium MoneyGuard Reserve. But any of the carriers can change their maximum issue age any time they want with notice and they do.

Few long term care insurance companies will offer coverage to individuals past age 80 according to the Association. Get direct access to can an 80 year old get long term care insurance through official links provided below. In contrast 565 percent of individual buyers last year were between 55 and 64 and the average age is now 57 down from 67 about a decade ago according to the associations data.

While not having any conditions might get you a better rate it is not impossible to get an affordable rate while taking some medications or being treated for some illnesses. It is possible to still purchase long-term care insurance at age 75 according to the latest information shared by the American Association for Long-Term Care Insurance. Long term care insurance is issued based on the insurance companys medical underwriting.

Only after you passed these qualifications will you be issued a policy. These costs increase with age as seen with online quotes from Mutual of Omaha. Find the official insurance at the bottom of the website.

If you still cant access can an 80 year old. People with a need for care want to coverage but they can not meet the health requirements and applications were just a waste of time and cost for the insurers Slome notes. Most new policies for this type of insurance and long-term care also stop after the age of 75.

The research above agrees with my own inquiry into long-term care insurance. It is a misconception that you cant get coverage if you are not 100 healthy. Go to can an 80 year old get long term care insurance page via official link below.

These rates are for a 10 year term life insurance policy at age 70 -75. Follow these easy steps. Buying a long-term care insurance policy for your parent may be a good idea to help with expenses if you are ultimately going to be responsible for caring for your aging parent.

The one we are illustrating does. Los Angeles CA Aug 5 2015 Finding long term care insurance coverage after age 70 is difficult as leading insurers scrutinize health and most stop issuing new policies after age 75. The question of age is important because every year older before you buy a policy cost goes up.

The maximum age for applying varies by carrier. A married 60-year-old female will pay 167 and 327 per month for 2100 to 4100 in monthly benefit amounts which. A new video posted by a trade group explains an option worth considering.

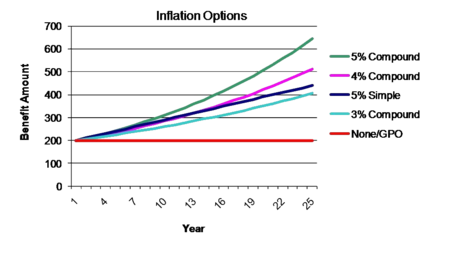

So by age 65 the 172600 benefit you bought at age 55 -- will have grown in benefit value to 276000. As noted earlier research suggests that 40 of the general population between age 50 and 71 can expect rejection. Yes you can buy long-term care insurance for your parent.

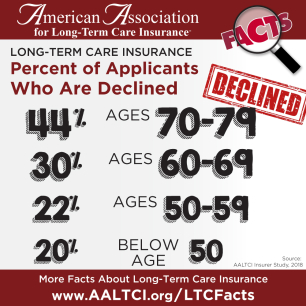

I dont know if you have family who would help take care of you but if you are single theres another advantage to having LTC insurance A good company will actually help you choose a home and make the payments lifting some of the responsibility at a time when you are not able to handle things. When it comes to applying for long term care insurance approximately 45 of applicants over the age of 70 are denied coverage. Term Life Insurance Rates for 70 75 Year Olds.

This is not the truth whatsoever. Long-term care insurance protection should grow to keep pace with rising costs. Long Term Care Insurance Option For Seniors Between 75 and 79 Explained.

There is a myth that surrounds the life insurance world that says seniors of the age 70 or older cannot obtain new life insurance coverage from any insurance company due to their age andor decreasing health with pre-existing conditions. Last year 35 percent of individual policies were bought by people age 44 or under according to the American Association for Long-Term Care Insurance which tracks industry data and trends. We recommend looking into a long term care plan between 50-60 years of age.

This is unlike health insurance for seniors because you wont be rejected for a health insurance policy based on your health history. It means even if you want long-term care insurance theres a good chance youll be rejected. Long Term Care Insurance for Ages 75-to-79 -Long Term Care option for seniors between 75 and 79.

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Allianz Long Term Care Insurance Life Insurance Blog

Allianz Long Term Care Insurance Life Insurance Blog

How Much Does Health Insurance Cost In Germany

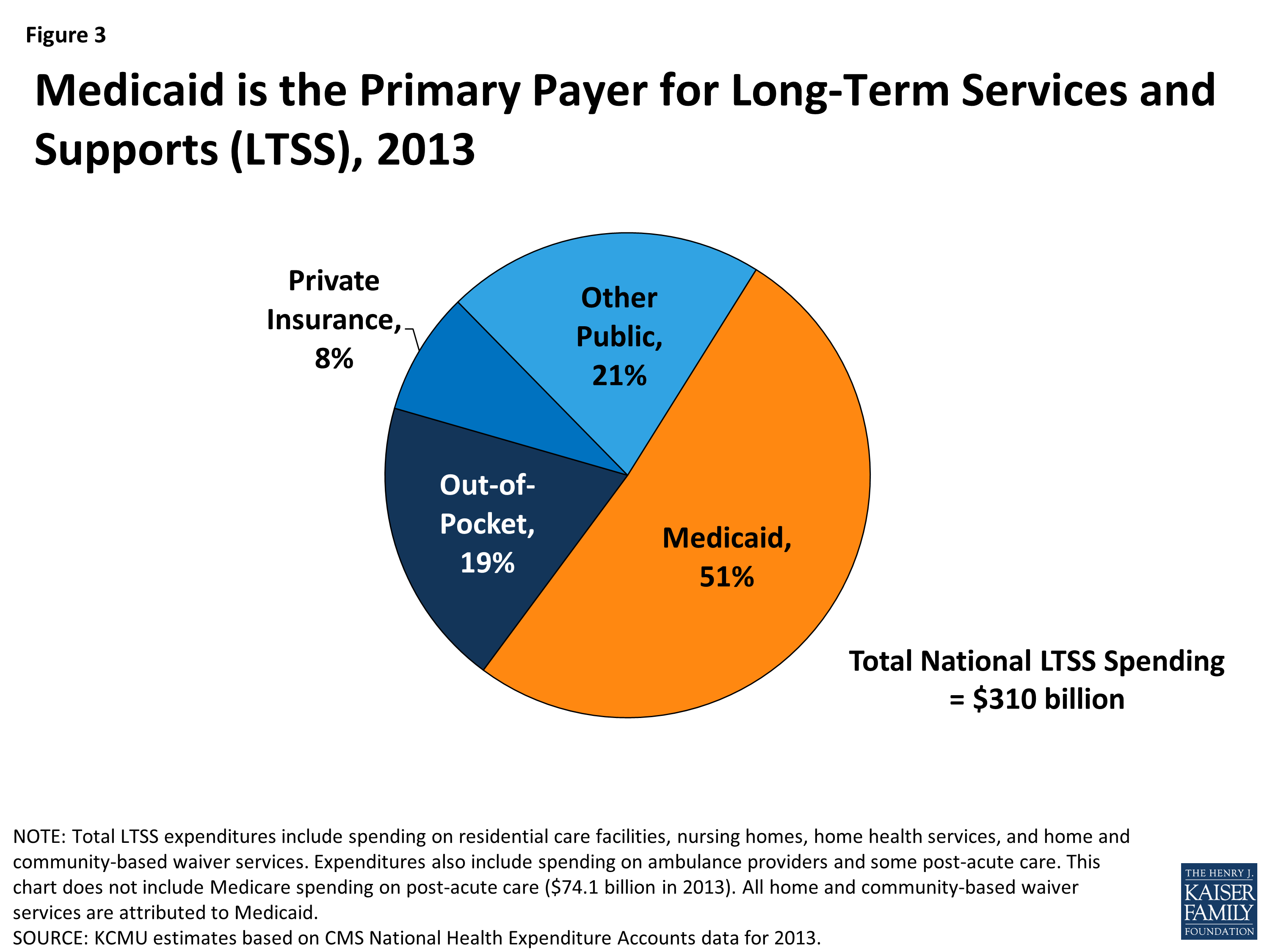

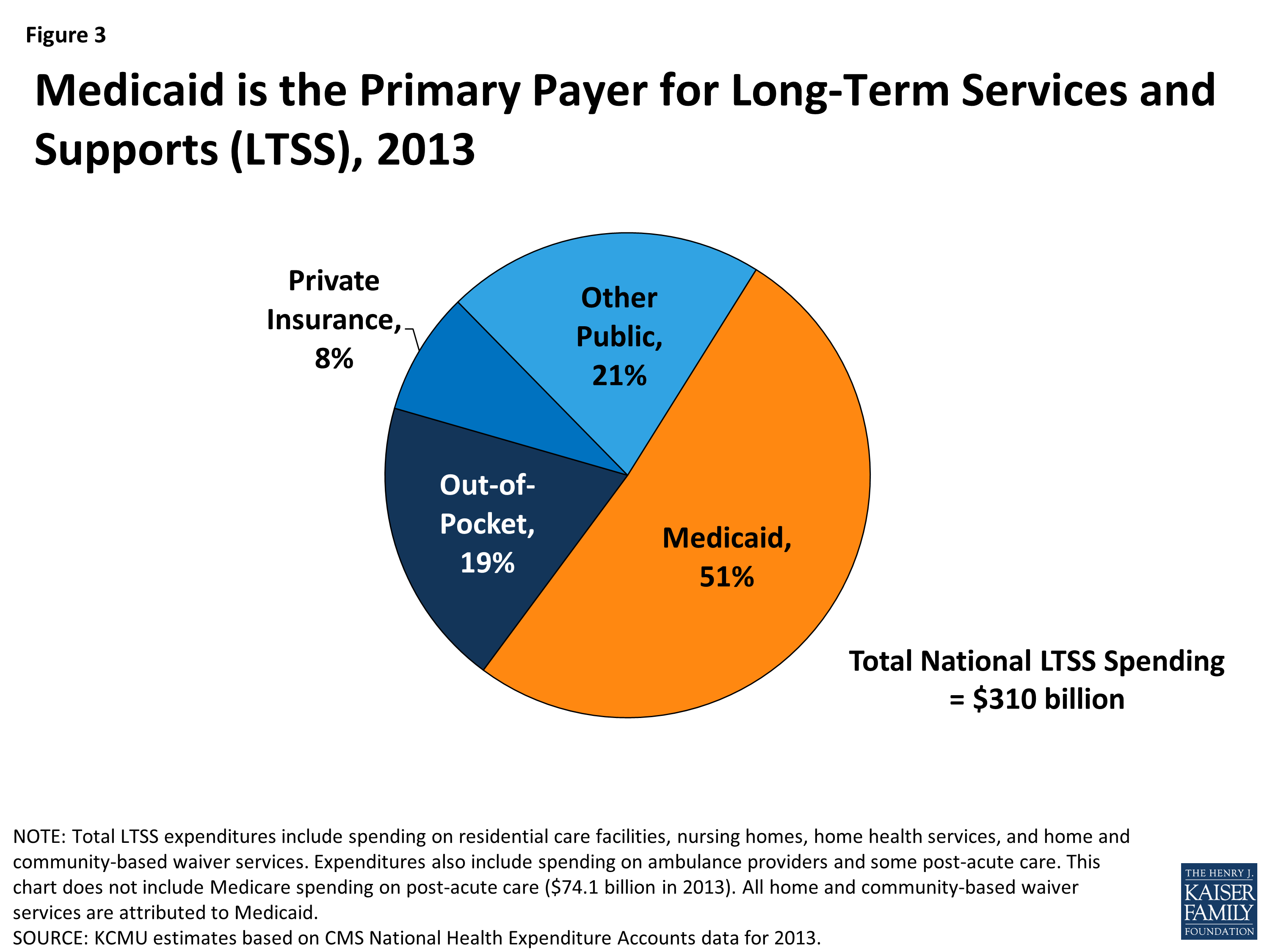

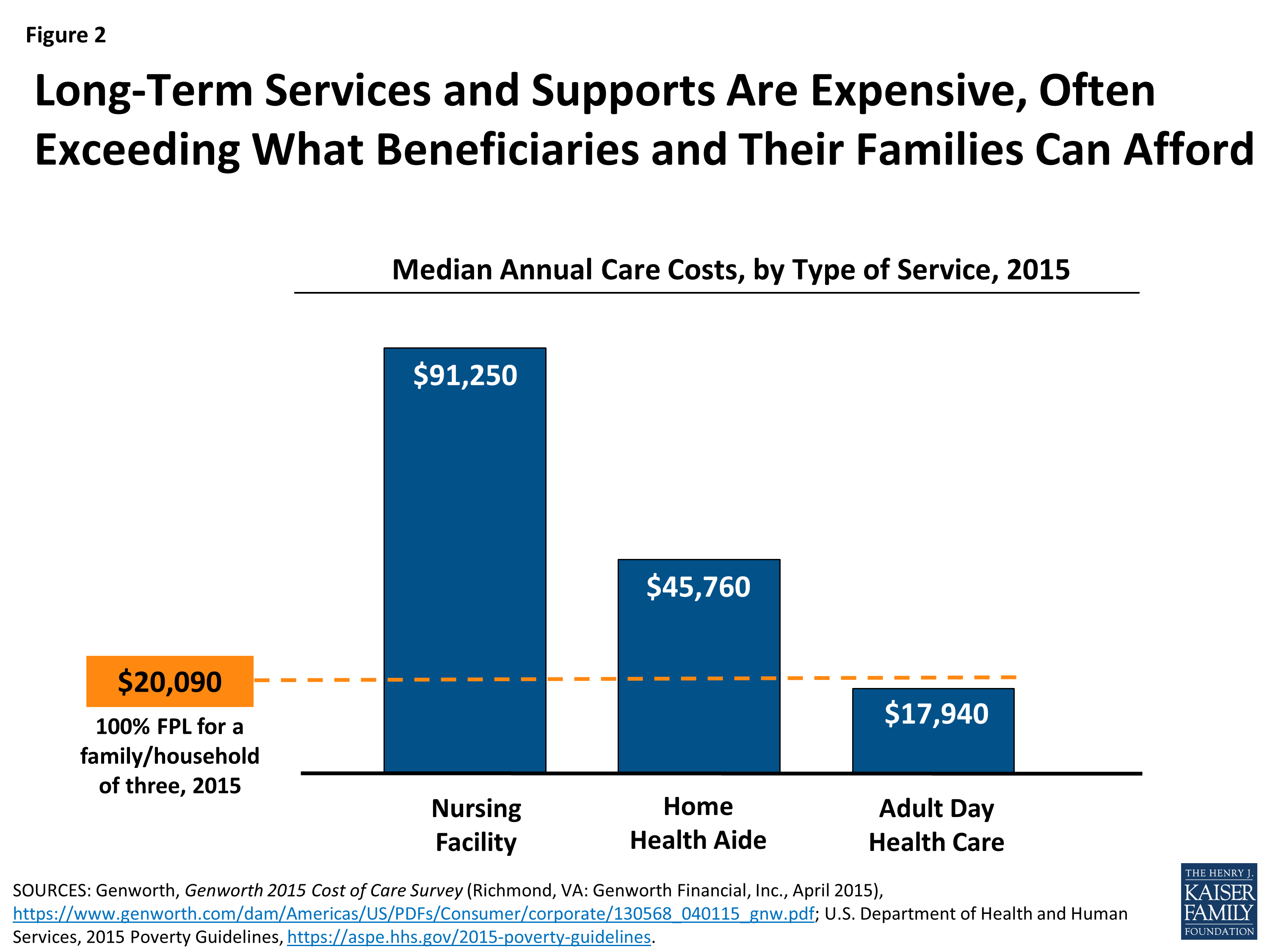

Medicaid And Long Term Services And Supports A Primer Kff

Long Term Care Insurance Costs Compare Quotes From Leading Long Term Care Insurance Companies

Long Term Care Insurance Costs Compare Quotes From Leading Long Term Care Insurance Companies

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

How Much Does Long Term Care Insurance Cost Smartasset

Allianz Long Term Care Insurance Life Insurance Blog

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Long Term Care Insurance Inflation Protection Options Long Term Care Insurance

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Tax Deductible Long Term Care Insurance Tax Limits Ltc Federal Tax Limits State Deductions For Long Term Care

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

:max_bytes(150000):strip_icc()/shutterstock_218198743-5bfc2eaec9e77c0058779e0a.jpg)

4 Best Alternatives To Long Term Care Insurance

Medicaid And Long Term Services And Supports A Primer Kff

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Post a Comment for "Can A 75 Year Old Get Long Term Care Insurance"